Stewart, host of Comedy Central’s “The Daily Show,” has been observing not only the collapse of the national economy, but also the forecasts and the reporting on CNBC, the business news channel. Over the last few weeks or so, he’s focused his attention (and his ire) on Jim Cramer, the animated host of “Mad Money,” a program that purports to cut to the chase of the day’s financial news with straightforward, practical advice for the everyday investor.

Cramer, no shrinking violet, returned fire on his program, and in those few weeks the sniping between the two reached a certain fever pitch. It came to a head on Thursday, when Cramer was a guest on “The Daily Show.” The metaphor of Daniel in the lion’s den doesn’t quite do it justice. The Stewart-Cramer confrontation was more lopsided than that.

◊ ◊ ◊

The background: For years now, since “Mad Money” went on the air in March 2005, Cramer has assumed a persona as the wild man of the markets, using a manic, snarling public style that gained gravitas from Cramer’s status as a former hedge fund manager, former stock trader and co-founder of TheStreet.com, a respected (and publicly traded) financial news and analysis Web site.

The background: For years now, since “Mad Money” went on the air in March 2005, Cramer has assumed a persona as the wild man of the markets, using a manic, snarling public style that gained gravitas from Cramer’s status as a former hedge fund manager, former stock trader and co-founder of TheStreet.com, a respected (and publicly traded) financial news and analysis Web site. Over the years Cramer parlayed his red-meat style and financial experience into a genuine franchise, becoming one of CNBC’s signature on-air properties and most easily recognized personalities. He was constantly sought for counsel and analysis by mainstream news outlets — even as the financial crisis deepened late last year, and grumbling grew about the accuracy of many of Cramer’s calls on the market.

The stage was set for a showdown on Thursday, two days before "Mad Money's" fourth anniversary. Forgive the length of this post, but some issues, certain topical matters deserve to be experienced verbatim. Here, then, excerpts from a smackdown for the ages:

STEWART: So let me tell you why I think this has caused some attention. It's the gap between what CNBC advertises itself as and what it is and the help that people need to discern this. … Look, we are both snake oil salesmen to a certain extent —

CRAMER: I'm not discerning...

STEWART: But we do label the show as snake oil here. Isn't there a problem with selling snake oil and labeling it as vitamin tonic and saying that it cures impetigo ... Isn't that the difficulty here?

CRAMER: I think that there are two kinds of people: People [who] come out and make good calls and bad calls that are financial professionals, and there are people who say the only make good calls and they are liars. I try really hard to make as many good calls as I can.

STEWART: I think the difference is not good call//bad call. The difference is real market and unreal market. Let me show you...This is...you ran a hedge fund.

CRAMER: Yes I did.

What follows was a portion of a video clip from a late 2006 video of Cramer in an interview with Aaron Task, executive editor of The Street.com, discussing, among other things, how hedge fund managers profit when they sell stocks short — to derive a profit from the declining value of a stock.

CRAMER [IN VIDEO]: You know, a lot of times when I was short at my hedge fund and I was position short, meaning I needed it down, I would create a level of activity beforehand that could drive the futures. It doesn't take much money.

Video ends.

STEWART: What does that mean? …

CRAMER: I have been trying to rein in short selling, trying to expose what really happens. This is what goes on, what I'm trying to say is, I didn't do this but I'm trying to explain to people this is the shenanigans that —

STEWART: Well, it sounded as if you were talking about that you had done it.

CRAMER: Then I was inarticulate because … I barely traded the futures. Let me say this: I am trying to expose this stuff. Exactly what you guys do and I am trying to get the regulators to look at it.

STEWART: That's very interesting because — roll 210.

Another part of the previous video, this one described by Stewart as “210,” begins:

CRAMER [IN VIDEO]: I would encourage anyone who is in the hedge fund unit, do it because it is legal. It is a very quick way to make the money and very satisfying. By the way, no one else in the world would ever admit that, but I don't care.

TASK [IN VIDEO]: That's right and you can say that here.

CRAMER [IN VIDEO]: I'm not going to say it on TV.

Video ends.

CRAMER: It's on TV now.

STEWART: I want the Jim Cramer on CNBC to protect me from that Jim Cramer. …

STEWART: Now why, when you talk about the regulators, why not the financial news network? Isn't that the whole point of this? CNBC could be an incredibly powerful tool of illumination for people that believe that there are two markets: One that has been sold to us as long term: Put your money in 401ks. Put your money in pensions and just leave it there. Don't worry about it. It's all doing fine. Then, there's this other market; this real market that is occurring in the back room, where giant piles of money are going in and out, and people are trading them and it's transactional and it's fast.

But it's dangerous, it's ethically dubious and it hurts that long-term market. So what it feels like to us — and I'm talking purely as a layman — it feels like we are capitalizing your adventure by our pension and our hard earned money. And that it is a game that you know ... that you know is going on. But you go on television as a financial network and pretend it isn't happening.

CRAMER: Okay. First, my first reaction is absolutely we could do better. Absolutely. There's shenanigans and we should call them out. Everyone should. I should do a better job at it. But my second thing is, I talk about the shorts every single night. I got people in Congress who I've been working with trying to get the uptick rule. It's a technical thing but it would cut down a lot of the games that you are talking about. I'm trying. I'm trying. Am I succeeding? I'm trying.

STEWART: But the gentleman on that video is a sober rational individual. And the gentleman on Mad Money is throwing plastic cows through his legs and shouting "Sell! Sell! Sell!" and then coming on two days later and going, "I was wrong. You should have bought,” like — I can't reconcile the brilliance and knowledge that you have of the intricacies of the market with the crazy bullshit you do every night.

Eventually, Cramer tries to make penitent, pledging to make changes in his reporting and program style:

CRAMER: How about if I try it?

STEWART: Try what?

CRAMER: Try doing that. I'll try that.

STEWART: That would be great, but it's not just you. It's larger forces at work. It is this idea that the financial news networks are not just guilty of a sin of omission but a sin of commission. That they are in bed with them.CRAMER: No, we're not in bed with them. Come on. I don't think that's fair. Honestly. I think that we try to report the news …

STEWART: But this thing was ten years in the making.

CRAMER: Right.

STEWART: And it's not going to be fixed tomorrow. But the idea that you could have on the guys from Bear Stearns and Merrill Lynch, and guys that had leveraged 35 to 1 —

CRAMER: I know.

STEWART: — And then blame mortgage holders. I mean, that's insane. … I gotta tell you. I understand that you want to make finance entertaining, but it's not a fucking game. When I watch that I get, I can't tell you how angry it makes me, because it says to me, you all know. You all know what's going on. You can draw a straight line from those shenanigans to the stuff that was being pulled at Bear and at AIG and all this derivative market stuff that is this weird Wall Street side bet.

CRAMER: But Jon, don't you want guys like me that have been in it to show the shenanigans? What else can I do? I mean, last night's show —

STEWART: No, no, no, no, no. I want desperately for that, but I feel like that's not what we're getting. What we're getting is... Listen, you knew what the banks were doing and yet were touting it for months and months. The entire network was. And so, now to pretend that this was some sort of crazy, once-in-a-lifetime tsunami that nobody could have seen coming is disingenuous at best and criminal at worst. ...

The measure of the network, and the measure of the mess... CNBC could act as —No one is asking them to be a regulatory agency, but whose side are they on? It feels like they have to reconcile as their audience the Wall Street traders that are doing this for constant profit on a day-to-day for short term. These guys' companies were on a Sherman's March through their companies, financed by our 401(k)’s, and all the incentives of their companies were for short-term profit. And they burned the fucking house down with our money and walked away rich as hell, and you guys knew that that was going on. …”

◊ ◊ ◊

You can quibble with some of what Stewart said. But not much. The idea, for example, of Stewart speaking from the perspective of a “layman” is a little hard to swallow considering, according to Forbes, that Stewart earns about $14 million a year. Real laymen would be happy with half of half of half of that.

But that’s small potatoes. Cramer was deservedly owned. Pwnd. Schooled. Gutted like a fish. Stewart effectively called the question on the business press doing its job as disinteresting seeker and disseminator of facts, not as cheerleader for the elites of the corporate world.

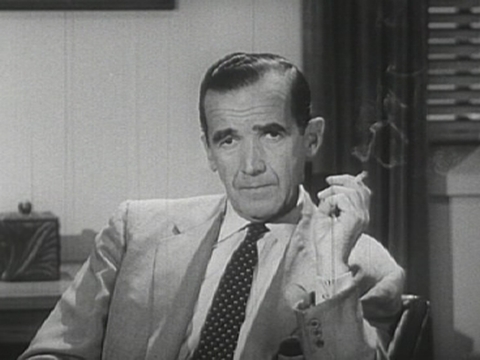

Sometimes — usually, in fact — a single distilling moment can slice through the rhetorical foliage of an issue. It happened in June 1954 when Joseph McCarthy was finally humbled by Army Special Counsel Joseph Welch in the Army-McCarthy hearings. On Thursday, Jon Stewart asked Jim Cramer, and by extension the business press as a whole, at long last, have you left no sense of integrity?

◊ ◊ ◊

Obviously, you knew this would be the shot heard round the Internet. Server farms across America glowed in the dark on Thursday night as recognized news outlets, and the blogosphere, weighed in.

“No responsible network executive who viewed the tape of Stewart eviscerating Cramer could possibly conclude that he has any credibility as an ‘investment expert.’ His antics may entertain some but they have hurt many,” wrote Dan Solis in The Huffington Post.

“For NBC and CNBC to continue to hold Cramer out as its investment guru would be a travesty that I don't believe even they will perpetuate. Here is a prediction I will make: Cramer will be off the air in sixty days."

“That might have been the most foolish appearance by someone whose name sounded like 'Cramer' since 'Seinfeld' went off the air,” Brian Lowry wrote in Variety.

Joe Peyronnin, an advisor to new media companies and an adjunct journalism professor at New York University, pretty much nailed it in The Huffington Post: “Edward R. Murrow would have been proud were he alive today.”

◊ ◊ ◊

Thursday the 12th was not a good day for Jim Cramer or CNBC, and Friday the 13th was no better.

That was when Portfolio’s Jeff Bercovici reported that the cumulative effect of the Cramer-Stewart broadsides were having a bad effect on CNBC ratings:

That was when Portfolio’s Jeff Bercovici reported that the cumulative effect of the Cramer-Stewart broadsides were having a bad effect on CNBC ratings:“In the first three days of this week, CNBC's Business Day programming block was down 10 percent in the key demographic of adults 25-to-54 versus the same period the week before, and down 11 percent among total viewers. Meanwhile, Mad Money was also down 10 percent in the 25-to-54 demographic, but only 4 percent among all viewers,” Bercovici reported of a trend already setting in before the Thursday night massacre.

Friday was when the first calls for Cramer’s scalp went out. “What is clear now is that Cramer at the very least was presenting a view of the market on air that couldn't have represented what he knew to be true,” wrote Steve Rosenbaum in The Huffington Post. “As he explained in one of the taped 'instructions', Cramer said you can move the market with rumor and innuendo. No surprise, but does CNBC endorse that Cramer’s Mad Money show is entertainment, or financial advice? There's no doubt they're meeting to throw him under the bus this very morning.”

And Friday was when the chief executive of TheStreet.com put in a sell order of his own. Hilary Potkewicz of Crain’s New York Business reported that Thomas Clarke, TheStreet.com’s CEO for the past decade, resigned, effective immediately.

And Friday was when the chief executive of TheStreet.com put in a sell order of his own. Hilary Potkewicz of Crain’s New York Business reported that Thomas Clarke, TheStreet.com’s CEO for the past decade, resigned, effective immediately.Potkewicz reported that Cramer issued a boilerplate statement upon Clarke’s exit. “I want to thank Tom for his long-time service to the Company and wish him the best of luck in his future endeavors,” it read in part.

The per-share price of The Street.com fell to below $2 per share this week, down from $9.50 a year ago. When the company first went public, in May 1999, it fetched $60 a share, a per-share price that fixed the company’s worth at about $1 billion.

That was then. In the current bear market, in a post-Stewart world, Cramer’s own portfolio is sure to be in decline for some time to come. While you still can, watch “Mad Money” weeknights at 6 on CNBC. You’ll likely be watching the antics of a man who’s already sold his own stock short.

◊ ◊ ◊

Postscript: What looked like a match of Cramer vs. Stewart was really a case of Cramer vs. Cramer vs. Stewart. As good as Stewart’s on-air distillation of Cramer’s financial shenanigans was on Thursday night, there’s nothing to substitute for a longer version of Cramer’s interview with Task, the editor at TheStreet.com.

Time and the need to focus on his guest no doubt kept Stewart from showing more of the tape. We don't have that problem here; therefore, feast your eyes on a six-minute version of Cramer unexpurgated — and unplugged — below. By the end, you'll see why Cramer's days as a financial maven at CNBC must, as a matter of journalistic integrity, be seriously numbered.

Cramer vs. Cramer indeed: The contradictions between the fulminating host of “Mad Money” and the savvy, ruthless, calmly rapacious and ethically challenged trader in the video below point to a man at odds with no one but himself.

-----

Image credits: Edward R. Murrow: Public domain. CNBC logo, Mad Money logo: © 2009 NBC Universal. Cramer-Stewart two-shot: Jason deCrow, The Associated Press.

No comments:

Post a Comment